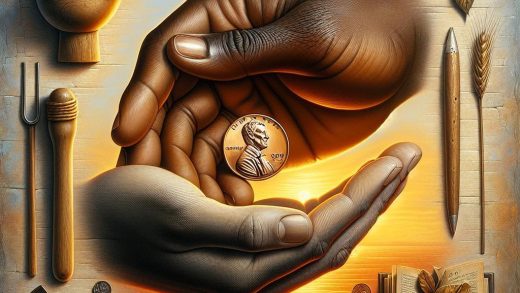

In a world where convenience often trumps caution, staying mindful of your financial transactions is crucial to avoiding costly mistakes. From overlooked subscription fees to unauthorized charges, the consequences of neglecting your bank account and credit card statements can add up quickly. By making a habit of regularly checking your accounts, you can safeguard your hard-earned money from unnecessary fees and fines. Join us as we explore the benefits of monitoring your finances and the simple steps you can take to protect your financial well-being.

The Importance of Regularly Monitoring Your Bank Account and Credit Card Statements

Regularly monitoring your bank account and credit card statements is crucial in staying on top of your finances and avoiding unnecessary fees and fines. By checking your statements frequently, you can catch any unauthorized transactions or errors early on, preventing further financial damage. Additionally, keeping track of your spending habits can help you identify areas where you can cut back and save money. Here are some key reasons why you should make it a habit to regularly review your financial statements:

- Identify Fraudulent Activity

- Avoid Overdraft Fees

- Track Your Spending

Avoiding Unnecessary Fees and Fines: Tips for Monitoring Your Finances

Regularly checking your bank account and credit card statements is essential in avoiding unnecessary fees and fines. By staying on top of your finances, you can catch any discrepancies or unauthorized charges early on, preventing potential financial losses. Setting aside time each week to review your transactions can help you identify any errors or fraudulent activity quickly. Utilize online banking and mobile apps to easily monitor your accounts, set up alerts for large transactions or low balances, and track your spending habits. Don’t overlook the importance of monitoring your credit report regularly to catch any potential errors or signs of identity theft. By taking proactive steps to monitor your finances, you can ensure that you are in control of your money and avoid any unexpected fees or fines. In conclusion, staying on top of your finances by regularly checking your bank account and credit card statements is key to avoiding unnecessary fees and fines. By developing this simple habit, you can better manage your money and avoid any surprises that may come your way. Remember, a little vigilance now can go a long way in securing your financial future. So, mind your money and watch it grow!