In a world where opportunities abound yet seem fleeting, the quest for financial growth has become more critical than ever. Investing in profitable projects—whether through the familiar corridors of stocks and bonds or the expansive landscapes of alternative ventures—presents a pathway to not only secure one’s financial future but also to unlock hidden potentials within the economy. This guide aims to illuminate the principles of successful investing, demystifying the intricacies associated with various investment avenues. By delving into the strategies that can optimize returns while managing risks, we set out on a journey to empower you, the investor, with the knowledge needed to navigate this dynamic market. Whether you’re a seasoned pro or a curious newcomer, join us as we explore the art and science behind making informed investment decisions that can yield lasting rewards. Welcome to the first step in unlocking your potential.

Exploring Investment Avenues for Thriving Returns

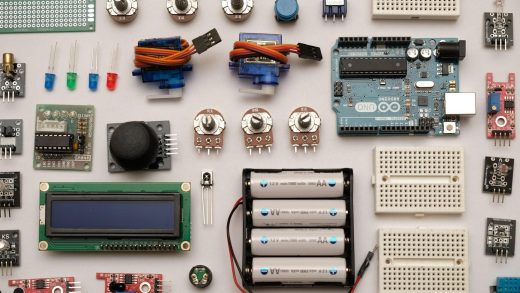

In today’s dynamic financial landscape, diversifying your investment portfolio is key to achieving robust returns. By tapping into various opportunities, you can mitigate risks while maximizing gains. Consider these avenues:

- Stocks: Investing in individual companies allows for potential high returns, but be mindful of market volatility.

- Bonds: These fixed-income securities are ideal for risk-averse investors looking for steady income over time.

- Real Estate: Property investments can yield rental income and capital appreciation, making them a tangible asset option.

- Mutual Funds: Pooling resources with other investors can diversify your holdings and reduce the pressure of individual stock selection.

- Emerging Markets: Investing in developing economies presents opportunities for growth that can outpace more stable markets.

Additionally, it’s crucial to stay informed about market trends and potential shifts in economic policies that could affect your investments. Utilizing technology and analytical tools can also enhance your decision-making process, ensuring you stay ahead in this ever-evolving financial environment.

Strategic Insights for Identifying High-Impact Projects

Identifying projects that promise high returns requires a strategic approach that combines market analysis, stakeholder engagement, and trend forecasting. Start by conducting thorough market research to pinpoint areas of high demand and low competition. Engage with potential users or clients to better understand their needs through surveys and focus groups, as their insights can illuminate promising project angles. Utilize SWOT analysis to evaluate the strengths, weaknesses, opportunities, and threats associated with each potential project, ensuring that the chosen initiatives align with your overarching strategic goals. Furthermore, consider the risk-to-reward ratio; projects with a historically solid performance or innovative twists can significantly enhance investment viability.

| Criteria | Description | Evaluation |

|---|---|---|

| Market Demand | Assess the current and projected need for the project’s outcome. | High, Medium, Low |

| Competitive Advantage | Evaluate what sets your project apart from others. | Strong, Average, Weak |

| Resource Availability | Determine availability of necessary resources (financial, human, and technological). | Abundant, Scarce |

| Return on Investment (ROI) | Calculate potential ROI compared to other investment opportunities. | High, Moderate, Low |

By applying this multifaceted framework, you empower yourself to select projects that not only hold promise but also mitigate risks—creating a sustainable investment strategy akin to diversifying a financial portfolio.

To Wrap It Up

As we conclude our exploration of “Unlocking Potential: Your Guide to Investing in Profitable Projects Like Stocks and Bonds,” it’s important to remember that the realm of investment is not merely about numbers and charts; it’s a journey towards building a future rich with opportunities. By cautiously balancing research and intuition, you step onto a path that can lead to financial growth and sustainability.

Every successful investor knows that understanding the landscape of profitable projects requires patience, diligence, and a keen eye for potential. Whether you find yourself drawn to the dynamic world of stocks or the stability of bonds, each investment choice is a chapter in your financial story waiting to be written. As you navigate this intricate maze, stay curious and remain open to learning—your most valuable asset is not just your capital, but your knowledge and perspective.

In a world where every decision shapes your financial future, may you unlock the doors to success with confidence and clarity. Happy investing!